Unknown Facts About Hard Money Atlanta

Wiki Article

Things about Hard Money Atlanta

Table of ContentsTop Guidelines Of Hard Money AtlantaThe Best Strategy To Use For Hard Money AtlantaHard Money Atlanta Fundamentals ExplainedHard Money Atlanta Can Be Fun For Anyone

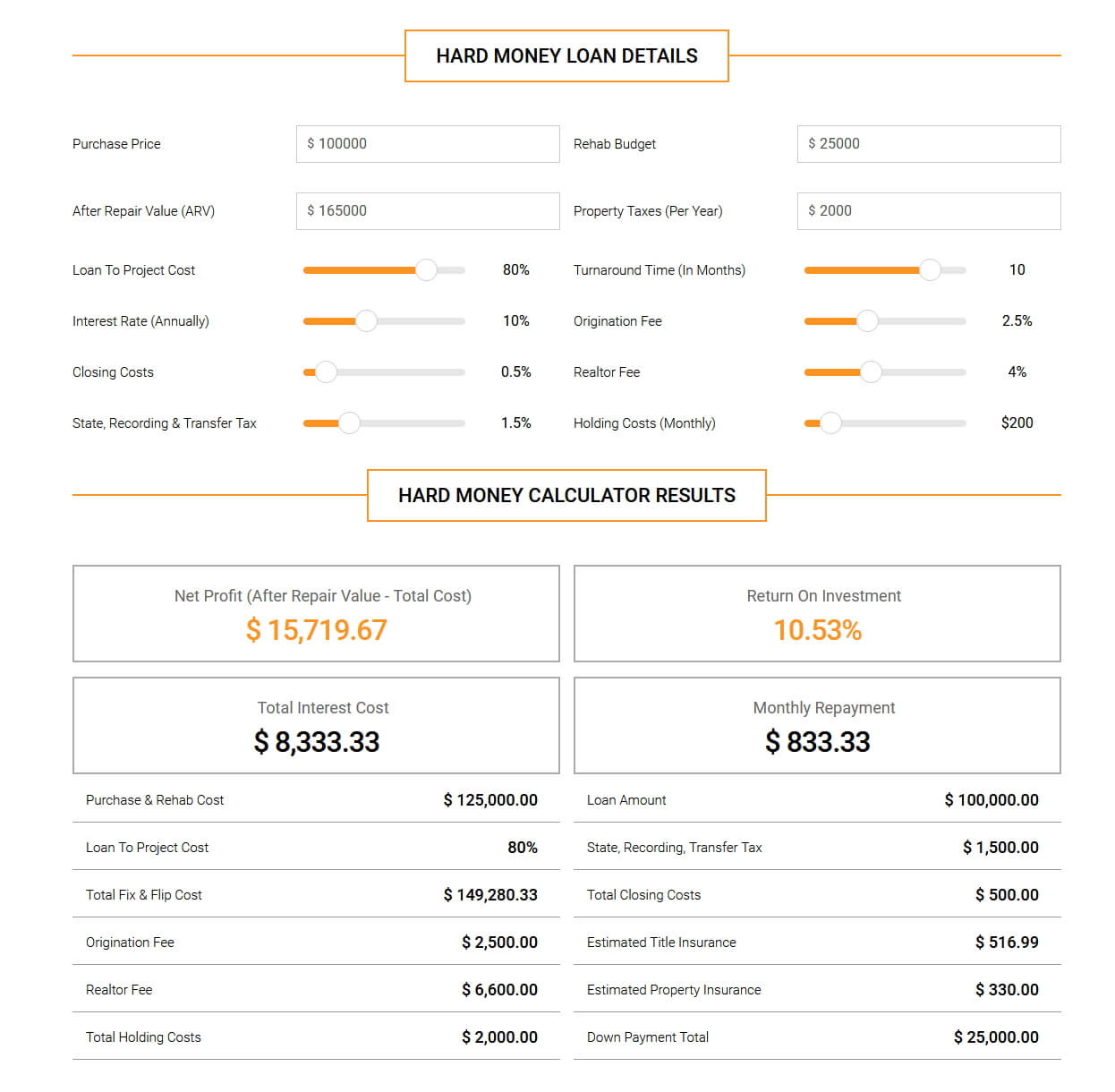

By contrast, passion rates on difficult cash finances start at 6. 25% however can go a lot higher based upon your location as well as the residence's LTV. There are other expenses to remember, as well. Hard money loan providers commonly bill factors on your financing, often described as origination charges. The factors cover the administrative costs of the car loan.

Factors are commonly 2% to 3% of the finance quantity. Three factors on a $200,000 funding would be 3%, or $6,000.

The Buzz on Hard Money Atlanta

You can expect to pay anywhere from $500 to $2,500 in underwriting charges. Some hard cash lending institutions additionally charge early repayment charges, as they make their money off the passion fees you pay them. That implies if you pay off the car loan early, you might need to pay an additional fee, including to the finance's cost.This means you're most likely to be provided financing than if you requested a standard home loan with a doubtful or thin credit rating. hard money atlanta. If you require money quickly for improvements to turn a house for earnings, a difficult money financing can provide you the cash you need without the hassle as well as documents of a typical home loan.

It's a strategy financiers make use of to purchase financial investments such as rental buildings without utilizing a great deal of their own possessions, and also difficult cash can be useful in these circumstances. Although hard cash car loans can be valuable genuine estate investors, they need to be used with care specifically if you're a novice to actual estate investing.

If you default on your financing repayments with a hard cash lender, the effects can be severe. Some financings are personally assured so it can damage your credit history.

The 9-Minute Rule for Hard Money Atlanta

To locate a reputable lending institution, talk to trusted realty representatives or mortgage brokers. They may be able to refer you to lending institutions they have actually worked with in the past. Hard money loan providers additionally often attend useful site genuine estate capitalist conferences to make sure that can be an excellent area to get in touch with lenders near you. hard money atlanta.Equity is the worth of the building minus what you still owe on the home mortgage. The underwriting for home equity financings also takes your credit score background and also revenue right into account so they often tend to have lower interest rates as well as longer payment durations.

When it pertains to moneying their next offer, investor as well as entrepreneurs are privy to several offering options essentially produced realty. Each includes particular needs to gain access to, and if utilized effectively, can be of substantial advantage to financiers. One of these loaning kinds is difficult money loaning. hard money atlanta.

It can likewise be labelled an asset-based finance or a STABBL car view publisher site loan (temporary asset-backed bridge financing) or a bridge loan. These are acquired from its particular temporary nature and also the demand for tangible, physical security, normally in the form of actual estate home.

The Facts About Hard Money Atlanta Uncovered

They are considered as temporary bridge financings as well as the significant usage situation for difficult cash car loans remains in realty transactions. They are considered a "hard" cash funding as a result of the physical asset the genuine estate building required to safeguard the funding. In the occasion that a borrower defaults on the finance, the lender books the right to presume possession of the residential or commercial property in order to recuperate the finance sum.As a result, demands may vary considerably from loan provider to loan provider. If you are looking for a financing for the initial time, the authorization process might be relatively rigorous and you might be needed to offer extra information.

This is why they are mostly accessed by property entrepreneurs that would typically need rapid funding in order to not lose out on warm opportunities. On top of that, the lending institution generally thinks about the worth of the possession or home to be acquired instead than the debtor's individual money history such as credit rating or earnings.

A conventional or financial institution loan might use up to 45 days to close while a difficult money financing can be closed in 7 to 10 days, in some cases you could try here quicker. The convenience and also rate that hard cash finances provide stay a major driving pressure for why genuine estate capitalists choose to use them.

Report this wiki page